Newly analyzed mapped data is drawing fresh attention to a troubling but often overlooked reality in the United States: millions of households report having no income at all. While national economic headlines frequently focus on job growth, stock markets, and average wages, this data reveals a very different story beneath the surface. The geographic distribution of zero-income households shows that economic hardship is deeply uneven, concentrated in specific states and regions, and shaped by long-standing structural challenges.

What Does “No Income” Actually Mean

A household classified as having no income is one that reports zero earnings from wages, self-employment, Social Security, pensions, investments, or other regular income sources over a defined period. This does not necessarily mean these households receive no support at all. Some may rely on savings, informal family assistance, public aid, or non-cash benefits. Still, the absence of reported income places these households among the most financially vulnerable groups in the country.

Unlike traditional poverty measures, which include people earning some income below a threshold, zero-income data highlights the most extreme edge of economic insecurity. These households often face immediate challenges meeting basic needs such as housing, food, utilities, and healthcare.

What the Maps Reveal Across the United States

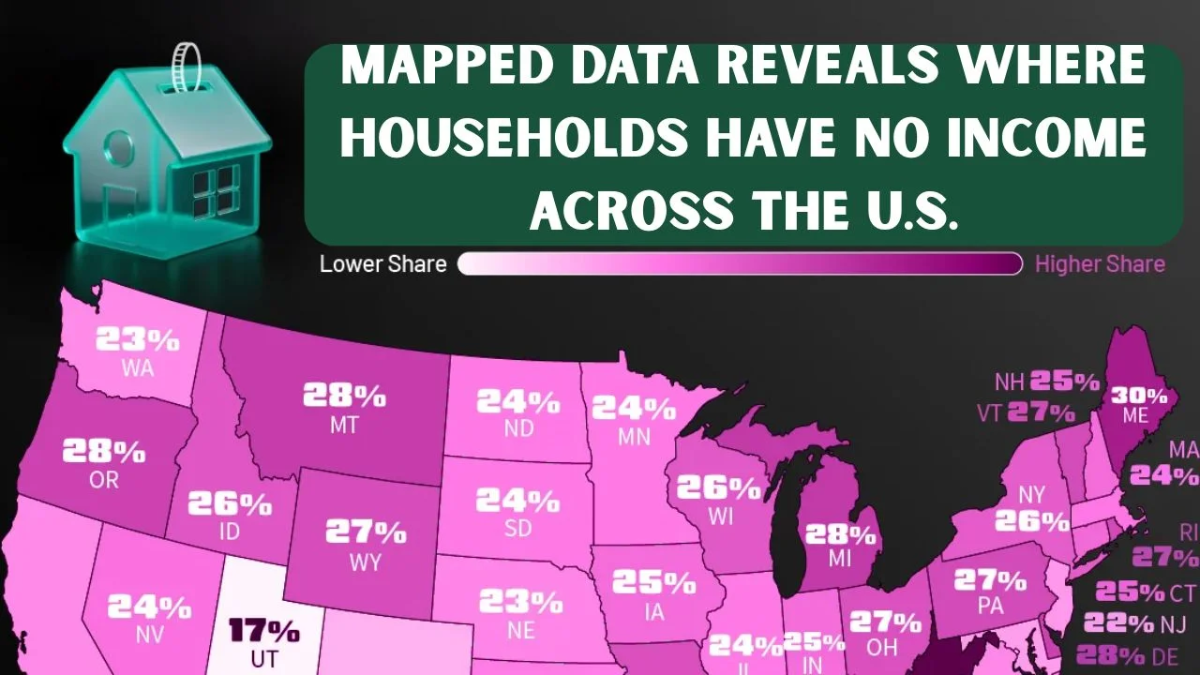

Mapped data showing the share of households with no income across U.S. states reveals clear geographic patterns. Higher concentrations tend to appear in parts of the Southern United States, sections of Appalachia, and some rural Midwestern and Plains states. In contrast, many coastal states and areas with large metropolitan economies show lower proportions of zero-income households.

These patterns closely mirror broader trends in economic opportunity. Regions with limited access to stable employment, lower educational attainment, and declining industries often show higher shares of households without income. Rural isolation, reduced infrastructure investment, and shrinking labor markets contribute significantly to these disparities.

Why Mapping Zero-Income Households Matters

Mapping no-income households provides insights that raw statistics alone cannot. Visual data highlights where hardship is clustered rather than evenly distributed. This geographic clarity is essential for policymakers and community organizations attempting to allocate resources effectively.

First, it identifies areas of extreme financial risk where households may be one emergency away from homelessness or food insecurity. Second, it helps explain why some regions experience persistent reliance on social services despite overall national economic growth. Third, it underscores the limitations of relying solely on averages or national indicators when evaluating economic well-being.

The Broader Income and Poverty Context

At the national level, median household income in the United States remains relatively high by global standards. However, averages can mask deep inequalities. Millions of Americans continue to live below the federal poverty line, and many more hover just above it with unstable or inconsistent income.

Zero-income households represent a subset of this broader population, often overlapping with long-term poverty statistics. These households are frequently found in areas designated as persistently poor, where high poverty rates have lasted for decades. Such persistence suggests systemic issues rather than short-term economic downturns.

Who Is Most Likely to Be Affected

Households with no reported income are not a single demographic group, but certain patterns appear consistently. Rural households are disproportionately represented, reflecting limited job availability and fewer economic alternatives. Older adults may also appear in zero-income data, particularly if they rely on non-reported support or savings rather than regular income streams.

People with disabilities, caregivers unable to participate fully in the labor force, and individuals facing long-term unemployment are also more likely to fall into this category. In many cases, barriers such as transportation, health issues, or lack of affordable childcare restrict access to stable employment.

Regional Inequality and Structural Challenges

The concentration of zero-income households in specific regions points to structural economic problems. Areas once supported by manufacturing, mining, or agriculture have struggled to adapt to economic shifts. Job losses in these sectors were often followed by population decline and reduced investment, creating a cycle that is difficult to reverse.

Limited broadband access, underfunded education systems, and inadequate healthcare infrastructure further compound these challenges. As a result, residents in these regions may face fewer opportunities to generate income, even during periods of national economic expansion.

How Policymakers Use This Data

Maps showing where households have no income are increasingly used as decision-making tools. Governments and organizations can use this data to target job training programs, expand access to education, and improve transportation and digital connectivity in high-need areas.

Economic development initiatives often rely on such mapping to prioritize funding and measure progress over time. When paired with data on housing costs, health outcomes, and employment trends, zero-income maps help create a more comprehensive picture of community needs.

Why This Data Matters Now

As economic pressures such as inflation, housing shortages, and healthcare costs continue to rise, households with no income face heightened risk. These families have little cushion to absorb price increases or unexpected expenses. Understanding where these households are located is critical for preventing deeper social and economic crises.

The data also serves as a reminder that economic recovery is not evenly shared. While some regions experience growth and prosperity, others remain stuck in cycles of hardship that require targeted, long-term solutions.

Conclusion

Mapped data revealing where households have no income across the United States exposes a stark and often hidden dimension of economic inequality. These maps show that financial hardship is deeply rooted in geography, shaped by history, infrastructure, and access to opportunity. Recognizing where zero-income households are concentrated is a crucial step toward designing policies that address not just poverty, but the underlying conditions that create and sustain it. As national conversations continue to focus on economic growth, this data reminds us that growth alone does not guarantee security for everyone.

Disclaimer: This article is for informational purposes only and reflects publicly available economic data and analysis.